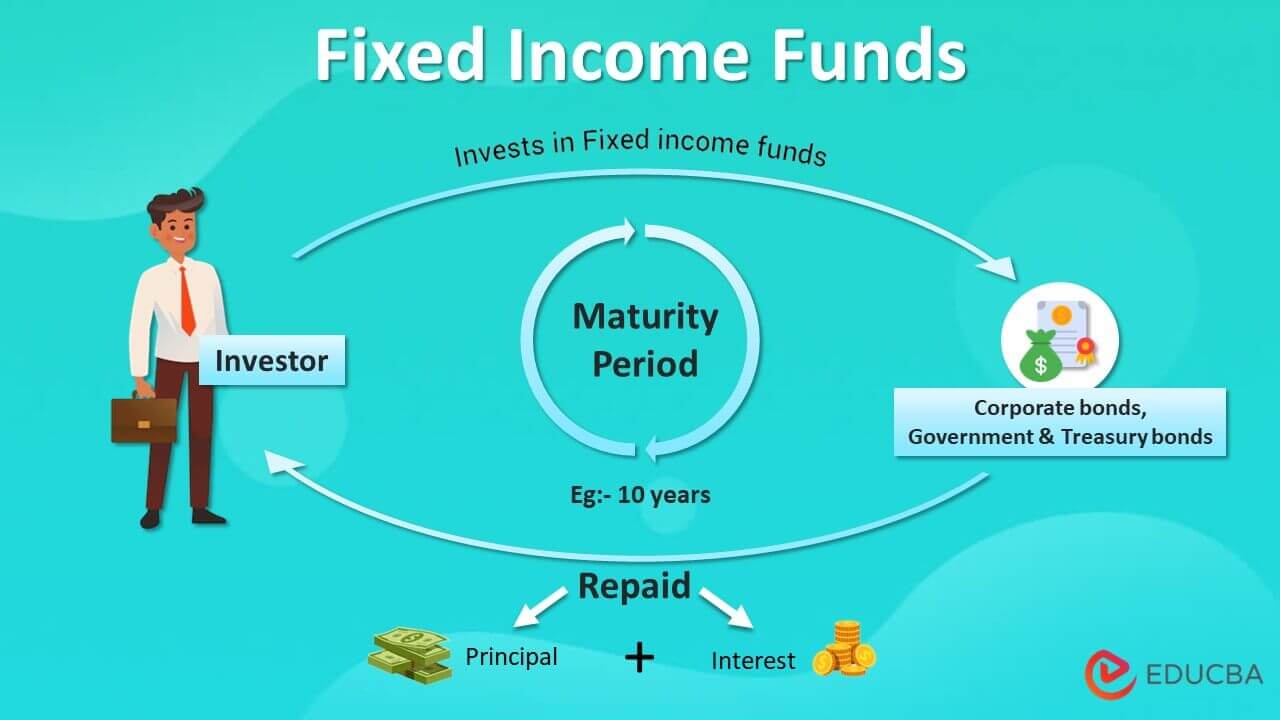

When someone borrows money, one has to return the principal borrowed to the lender in the future. There could also be some interest payable on the amount borrowed.

There are various forms of borrowing, some of which are through marketable instruments like Bonds and Debentures.

There are many issuers of such papers, e.g., Companies, Union Government, State Governments, Municipal Corporations, Banks, Financial institutions, Public sector enterprises, etc.

Bonds are generally considered to be safer than equity. However, these are not totally free from risks.

Bonds can be classified into subcategories on the basis of issuer type i.e., issued by the Government or Corporates or On the basis of the maturity date: Short Term Bonds (ideal for liquidity needs), Medium Term Bonds, and Long-term Bonds (income generation needs).